Sphere of Activity

The Institute of Actuaries of Japan has over 5,000 members serving as professional actuaries in various fields

The IAJ currently has over 5,000 members. In its history of over 100 years, the majority of members have been primarily employed as professional actuaries in life and non-life insurance companies and trust banks. In recent years, many are also actively providing their specialized actuarial skills for governmental ministries and agencies, consulting firms, audit firms, and reinsurance companies as many more industries seek professionals who are highly trained in actuarial mathematics.

IAJ certification is a highly valued credential that is a legal requirement for becoming a Hoken Keirinin (Appointed Actuary) or Nenkin Sūrinin (Certified Pension Actuary) in a life insurance or pension company in Japan.

In the life insurance field

Support sound business operation by accurately assessing ultra-long-term risks

Life insurance is a service providing insurance against various life-threatening risks, such as a person’s subsistence, illness, or death.

Life insurance companies maintain decades-long contractual relationships with policyholders under which an individual pays a premium based upon which the company is obligated to pay insurance claims or benefits. Sound management is essential for a life insurance company to maintain a balance of income and expenditure and to enable it to respond to changes in the business environment.

Actuaries in the life insurance field analyze a company’s overall income and expenditure, calculate appropriate insurance premium amounts, and evaluate reserves for future insurance claims and benefit payments. The trends of financial liberation, aging societies, and declining populations have led to expanding roles for actuaries in recent years. As life insurers seek to expand their product and service ranges and to not just maintain but to strengthen the soundness of their business, actuaries are increasingly being used not just in actuarial mathematics and product development departments but also in corporate planning and risk management departments.

In the non-life insurance field

Support sound business operation by analyzing the risks for diverse, complicated insurance products

Non-life insurance is a service providing compensation for potential financial loss to households and business caused by various risks, such as accidents, disasters, or personal injuries. Actuaries play critical roles providing statistical analysis of the frequency and scale of various risks, developing products and determining policy content and premium amounts for changing business environments and client needs, and quantifying risk and calculating reserves for future insurance payments.

Actuaries conduct risk assessment using highly complex mathematical calculations, such as to determine automobile insurance premium amounts categorized by driver and vehicle characteristics, and to ensure sufficient reserve funds are available for disaster insurance that could require enormous payment amounts for infrequent one-time events, such as typhoons or earthquakes.

Actuaries are becoming indispensable for product development, underwriting, and risk management in the non-life insurance field.

In the pension field

Apply actuarial expertise to solve challenges to corporate pension programs

A company offering a corporate pension program to its employees relies on actuaries in the pension field to design a system that meets the company’s needs and to determine the premiums using actuarial methods of probability and statistical calculation.

Actuaries regularly verify the premium and reserve amounts and play important roles in debt valuation for corporate accounting of pension benefits. The role and duties of pension actuaries are growing with the widespread adoption of international accounting standards.

The management and review of corporate pension programs have become important management issues because of the programs’ potential to greatly impact a company’s finances and to serve as a personnel strategy for the company. Another major issue is the integration of corporate pension plans during corporate restructuring. Pension actuaries are also expected to have problem-solving skills and serve as consultants.

Japan's corporate pension system is in a transformation phase, and pension actuaries are increasingly being called upon for their expertise.

In the risk management field

Contribute probability and statistics expertise and create mathematical models that reach beyond the insurance and pension domains

Companies use enterprise risk management (ERM) to maximize corporate value by managing profit and risk through integrated, comprehensive, and strategic understanding and assessment of the entire organization’s business activities.

Actuaries are well versed in creating mathematical models for quantitative analysis from the wide variety of risk management services they have provided in the insurance and pension fields.

The actuarial profession maintains many characteristics that are essential to the field of risk management, such as the ethical standards in the Actuary Code of Professional Conduct.

The inherent attributes of the actuary profession and the ongoing internationalization of corporate activities are creating growing expectations that actuaries will play a greater role in ERM.

In other fields

Apply mathematical analysis and calculations to expand the field of activity as social and economic conditions change

As society and the economic conditions evolve, actuaries are being called on to apply their mathematical analytical and assessment skills in a growing range of new areas.

For example, actuarial skills have a high affinity with data science because of the similarities in the need to analyze a diverse range of data to identify the value that can be used in a business. Technological advances are also increasing demand for actuaries who can apply their skills to machine learning and other innovative analysis methods.

Distribution of Individual Members by Business Categories (as of March 31, 2022)

(Unit: person)

| Life insurance | Trust banking | Non-life insurance | Other | Total | |

|---|---|---|---|---|---|

| Fellows | 890 | 197 | 301 | 612 | 2,000 |

| Associates | 611 | 110 | 267 | 417 | 1,405 |

| Students | 724 | 59 | 296 | 1,013 | 2,092 |

| Total | 2,225 | 366 | 864 | 2,042 | 5,497 |

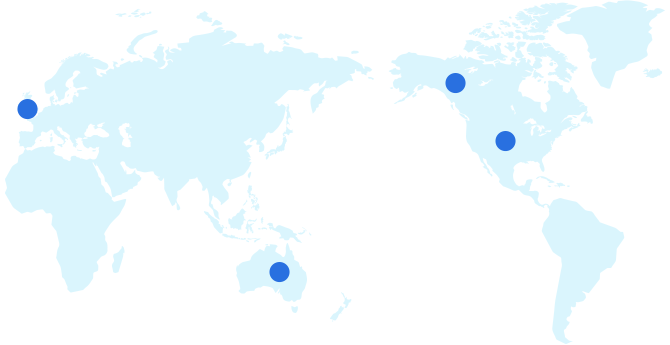

Overseas Actuarial Associations

Actuary certification is an internationally recognized qualification, and the IAJ has interaction with overseas actuarial associations. IAJ members are highly regarded by corporations as well as society as a whole.

- Actuarial associations in the United States

- Actuarial association in the United Kingdom

- Actuarial association in Canada

- Actuarial association in Australia